Explain the Different Type of Bills of Exchange

A bill of exchange issued by individuals is. It is drawn on a specific person ie.

Dishonor of Bill of Exchange.

. Such an endorsement does not operate as a negotiation of the instrument. Drawee The person who is responsible for acceptance and payment of the bill. Discounting of a Bill of Exchange.

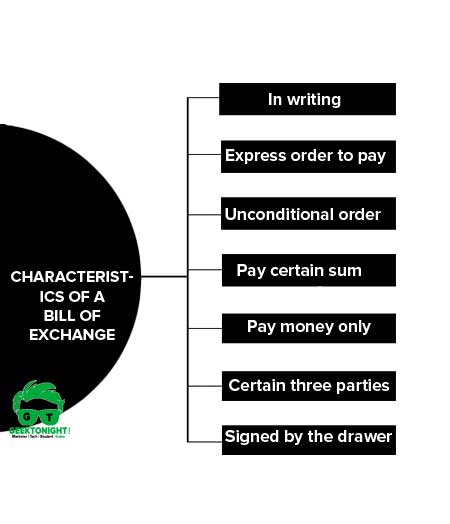

The following are the features of bills of exchange. They are payable at any time. A is the holder of a bill for Rs1000.

Now that you have a better understanding of what a BOE is here is a breakdown of the various types of bills of exchange. KINDS OF BILLS OF EXCHANGE. Bills of Exchange Payable at Sight.

Cheque is an instrument which contains an unconditional order drawn on a banker directing to pay a certain sum of money to the person whose name is specified in the instrument. Payment in the case of Foreign Trade is being done through the medium of bill of exchange. Inland bill means the bill which is drawn and payable within the same country.

Types of Bills of Exchange. A bill of exchange is generally drawn by the creditor on his debtor. B finance bills or promissory notes.

Types of Bills of Exchange. When the individual issues the bill it is known as trade draft. Important Questions for Bills of Exchange.

Retiring a Bill of Exchange Under Rebate. When the bank of exchange is generated or issued by the bank it is termed a bank draft. Bills may be of the following types.

Both the types of bill DA and DP are common in international trade. It is advantageous to different parties in the following ways. A bill of exchange is a document used in international shipping a negotiable instrument that is created by the seller or exporter and given to.

The bill does not have a fixed date of payment therefore the. It is drawn and signed by the maker ie. Drawee to pay the specified amount.

Section 13 1 of the Negotiable Instruments Act 1881 defines negotiable instruments as A promissory note bill of exchange or cheque payable either to order or to bearer. Different Types Of Bill Of Exchange. Types of Bill of Exchange.

A bill of exchange is a written and unconditional order issued by the drawer the seller of goodsservices and addressed to the drawee the buyer to pay a certain sum either immediately a sight bill or on a fixed date a term bill to a specified person usually the drawer himself or to the bearer of the bill. And c treasury bills used to meet temporary financial needs to the government. Documentary Bill-The Bill of Exchange is accompanied by the required documentation that attests to the validity of the sale or transaction between the seller and the buyer.

Demand Bill - It is a bill that must be paid when it is demanded. Contains an unconditional order to a person ie. Bills of Exchange After a Certain Period This is also called term draft and becomes payable after a certain time period.

Demand Bills of Exchange. Renewal of Bill of Exchange. Bills are of three types- a bills of exchange or commercial bills used to finance trade.

Difference Between Cheque and Bill of Exchange. Demand Bill- This bill is payable when it demanded. Bill of exchange is a negotiable instrument which is payable either to order or to the bearer.

Demand bills do not have a fixed date associated with them. These bills may be bought and sold in the discount market which consists of commercial banks discount houses and other institutions. Types and Classification of Bill of Exchange.

Bill of Exchange. There is no fixed date for the payment of such bill. On the basis of period bills are of two types.

PARTIES OF BILL OF EXCHANGE Drawer The person to whom the amount of bill is payable. Bills of Exchange Payable at Sight They are payable on demand. Endorsement of Bill of Exchange.

Bills of exchange can be based on period as demand bills and term bills. He endorses it pay to B or order Rs500. When the Bill is given to the drawee he or she must pay the amount.

Bills of Exchange Payable After a Certain Period of Time. Tem Bills of Exchange. In contrast Bill of Exchange is a document contains an unconditional order directing a.

The issuing bank guarantees payment on the transaction. As shown in the above image Bills of Exchange are normally of two types. Meaning of Bill of Exchange Bill of Exchange is a negotiable instrument which is a legally binding document containing an order to pay a certain sum of money to a person within a pre-determined time frame or on-demand by the bearer of the.

Bills of Exchange are of different types based on their functionality and nature. Accounting Treatment of Bill of Exchange. These types of bills are payable on demand and the drawee has to pay the amount when the bill is presented to him for payment.

There are mainly two types of Bills of Exchange. Types of Bill of Exchange on the Basis of Period. Drawer of the bill.

Thus the bill which is drawn in Pakistan and will also be paid in Pakistan is termed as an inland bill. Term bills of exchange are payable after a certain amount. They become payable at ay time when they are presented before payee by the holder.

Bill of Exchange Sent to Bank for Collection. A bill of exchange issued by a bank is referred to as a bank draft. Features of Bills of Exchange.

A bill of exchange an instrument in writing. Payee The person to whom the bill is payable. Insolvency of One Party.

Based on the requirement and mode of payment different types of bills of exchange are used. Importance of Bills of Exchange in the Financing of Foreign Trade. There are three types of Negotiable Instruments namely Bill of Exchange Cheques and Promissory Note.

Documentary Bill- In this the bill of exchange is supported by the relevant documents that confirm the genuineness of sale or transaction that took place between the seller and buyer. Last updated on July 26 2018 by Surbhi S. The bill which is drawn in one country and accepted and payable in another country is known as a foreign bill.

TYPES OF BILLS OF EXCHANGE. A partial endorsement is a type of endorsement in which purports to transfer to the endorsee a part only of the amount payable on the instrument.

What Is Bill Of Exchange Example Features Characteristics

Bill Of Exchange Meaning Definition Types Format Importance

Bills Of Exchange Questions By Learnwithtanvir Video 5 Youtube Vocabulary Workshop Language Vocabulary Vocabulary

/bill-of-exchange-55bea739977f49c2897cd068b609b956.jpg)

Comments

Post a Comment